Major exclusions in the Policy, general & specific mandatory waiting periods for certain illnesses, Third Party Administrators (TPAs) and their roles, network hospitals, procedures towards Cashless facility; Pre-approval, co-payment, sub-limits for expenses, etc., and the list goes on and on and on.

My intention is not to intimidate people with the above list but to make their life relatively easier with some of my learning experiences. Whilst it is a mammoth task for us to be able to successfully get our claims sorted out, it is hugely important that we all have our Health Insurance/ Mediclaim Policy. Otherwise the lifestyle diseases coupled with high medical costs would drain our financial resources or erode considerably the life term savings in the case of senior citizens. The sooner the better – considering the fact that there is a mandatory waiting period for claims in the case of certain illnesses. When it is mandatory for the vehicle owner to have valid Motor vehicle insurance, I fail to understand as to why the Government has not made it mandatory for the people to have their health insurance.

As someone, who went through the processes recently and having equipped with firsthand information and learning experience, I thought it is my duty to share them with you all through this Post, just in case some of us need to avail the Health Insurance facilities in the near or distant future – though it is not anybody’s wish.

My recent experience is with one of the Private Insurance companies. However, I would love to hear from people just in case, they have experience in dealing with other insurance companies (a) in Private Sector, e.g. Apollo Munich, Max Bupa, Star Health Insurance, etc. or (b) Public sector, e.g. United India Insurance Company Limited, National Insurance Company Limited, etc.

Unfortunately, my experience with the Private Insurance Company, with whom I have my relationship for nearly a decade, was not a pleasant one. Thank God I did not have an opportunity to deal with them during the last 10 years. [The positive side to this is that the cumulative bonus points get added to our sum insured for “no-claims” and thus this is an encouraging factor for us to keep renewing our Policies]. I had the unfortunate occasion a few days ago when I needed to interact with my Insurance Company for my illness – inguinal hernia. Hope, I wouldn’t be totally wrong in my perception that the Insurance Company was taking its customers for a ride. None of us expect that the terms and conditions of the Policy served by various Health insurance providers should be in favor of the customers. But it should be fair enough with fair practices and enable the customers to minimize or reduce considerably the huge medical costs.

TPA (Third Party Administrator):

I was aware in the case of my Insurance Company, that there was an additional layer in the form of Third Party Adviser (TPA) in between the Insurance Company and me – i.e. the customer. However, I was not aware of their roles, as I never had an opportunity in the past to know more about TPA. It was my mistake not to have found out, proactively, what this TPA meant and why their address was mentioned in my Certificate of Insurance. Incidentally, as TPA they have access to our personal details, besides the Insurance Company! I do not know if other private insurance companies employ / contract TPAs. This is something for us to find out before hand, as this will enable us to know whom to contact when there is a need or during emergency. This is because some of the Insurance Companies use TPAs to administer services, including claims administration, premium collection, enrollment and other administrative activities.

As I never took advantage of Health Insurance facilities in the past, I was in a confused state as to whether (i) I should pay upfront to the Hospital and claim reimbursement from my Insurance Company or (ii) inform the Insurance Company prior to my hospitalization & surgery and seek pre-approval from them. Like many others I was under the impression that I need not pay anything towards my hospitalization and medical costs just because I had a valid health insurance Policy with the sum insured far exceeding the estimated costs provided by the hospital. Unfortunately, it was not so. Even though we have a valid Health insurance policy for a reasonable amount of sum insured, the amount approved by the Insurance Company against our claim could be far less.

Though I knew the sum insured in my case, I was not aware as to how much the Insurance Company will approve or reimburse. This is a big worry for the customers, who are in need of treatment/surgery in a hospital, especially as an in-patient. The estimated cost for a couple of days stay in a reasonably good hospital for a common surgery could be anything from ₹ 1.20 to ₹ 1.50 Lakhs. If the treatment, consultation or medical procedure is planned then we can contact the insurance company or TPA either directly or through the Hospital where we intend to have the treatment and seek a pre-approval (Cashless service offered by the Insurance Company). In an emergency, the insurance company or TPA should be informed within 24 hours after the treatment or hospitalization.

There are various factors we need be aware like: mandatory waiting period for certain illnesses, exclusion clauses for certain illnesses, etc. This means even though we have a valid health insurance policy we cannot take advantage of it towards these illnesses for the simple reason that we have not completed the mandatory waiting period. Incidentally, this could be ranging from 2 to 4 years (4 years in the case of pre-existing diseases). Then there is a long list of exclusions. This is where we tend to think that most, if not all, of the terms and conditions are favorable to the insurance company.

Through the feedback system, I did inform the Hospital, as well, as to how they were equally unfriendly and indifferent when they deal with patients availing health insurance facilities. The Hospital’s billing section never informs and explains it to the Patient or the Attendant as to what was included in the bill either before or after they sent the bills to the Insurance Company for settling the claim.

From my recent experience, I found out that it is not as simple/easy as we think to avail ourselves of the Health insurance facilities and to get our claims administered by the Insurance Companies. It involves a lot of our time, efforts and negotiation skills. One can imagine how difficult it is for people in general and older persons in particular to spend time and persuade Insurance companies, especially if they themselves are patients. Besides, many elderly consumers of healthcare/health insurance are not savvy-consumers.

Considering the life style diseases and the huge medical costs, the bottom line is that we need to have health insurance, especially those who are retired with no fixed monthly income. We should remember to buy Policies from Insurance Companies registered with IRDAI (Insurance Regulatory Development Authority of India). Insurance companies such as Apollo Munich coming out with their own scheme even for Dengue fever called “Dengue Care Plan”. The medical costs would be very high even with Dengue fever, when it goes out of control and required hospitalization.

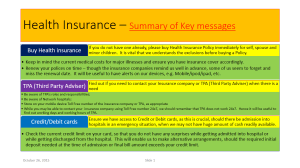

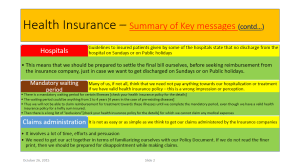

The summary of the key messages is given below in two separate slides:

As it is something useful and related to this Post, I am sharing with you a recent news item appeared in the Hindu dated October 16, 2015 – “State told to reimburse surgery expenses to School teacher” http://www.thehindu.com/todays-paper/tp-national/tp-tamilnadu/reimburse-surgery-expenses-to-teacher-hc-orders-state/article7768009.ece

According to the news item in the print edition, “The Madras High Court Bench in Madurai has directed the government to reimburse ₹ 44,581/- spent by a Madurai Corporation Middle School teacher for performing obstructed hernia surgery on her 10 month old son at a private hospital that was not part of a network of hospitals listed under the health insurance scheme for government employees” It was heartening to note that the High Court directed the Government to make sure that the amount was reimbursed along with interest at the rate of 9% from April 30,2014, when she had made the payment to the private hospital, to the date when the money would be handed over to her.

Excellent on the part of Judge to have delivered this judgment. I could not make out from the news item, if the direction included reimbursement of costs towards School teacher’s legal battle and compensation towards her mental agony for the last 15 months. We all hope and wish that the direction to the State Government included this, as well.

Hats off to the School teacher, who had to fight her case initially with the District Collector, Commissioner of Treasuries and Accounts, Insurance officials from United Insurance Company, etc. before seeking legal assistance from the High Court.

This is really encouraging, as we have a precedent now to use when some of us need to undergo treatment in a non-networked hospitals when in emergency.

IoT (Internet of Things) Technology in Insurance Industries:

Until I read a LinkedIn Pulse Post a couple of days ago [Internet of Things: A transformational force for the Insurance Industry by Mr. Rohit Bhisey}, I did not realize that the emerging technology, i.e. Internet of Things (IoT) has already started revolutionizing various sectors including Health insurance sector.

I was extremely happy when I read that “The Internet of things will help insurers price their products based on historical data and real-time data. This will allow insurers to provide customized and fair policies. The IoT will also help insurers reduce risk and mitigate costs in many ways. A few healthcare insurers are offering consumers lower premiums, free fitness trackers, and other benefits to help consumers meet their daily exercise goals”.

In my view, this area, i.e. Health Insurance or Mediclaim – lends itself to a variety of topics for research. Together with the emerging technology IoT (a new future of the Insurance industry), I think a world of opportunities exist for possible research in this area. For what it is worth, I am tempted to associate myself with any efforts in this direction.

Incidentally, masters students, research masters students and students registering themselves for Doctoral research would appreciate the huge potential this sector offers for research in terms of comparing various facilities the Health insurance provisions offered by both Public and Private Sector Insurance Companies. I am sure the research findings would be hugely useful and beneficial to all stakeholders, i.e. Insurance Companies in Public and Private sectors, Governments, Healthcare professionals, Hospitals, Doctors, customers, etc.

Hope the readers would not mind this long post.

Dear Sivakumar

First of all, wishing you a speedy recovery.

I wonder how much you would have paid the company all these years. Hope the company at least pay back what they have collected from you.

Incidentally, the hospitals also seems to conduct numerous unwanted tests and insist on immediate treatment for small ailments if they come to know that the patient has reimbursement facility or insurance cover.

best regards

Dhanasekaran

LikeLike